2019城市商业银行排名 北京银行净利润达200亿居首位(完整榜)

2022-07-23 02:39:12阅读量:5 字体:大 中 小

排行时报网讯,根据全国城市商业银行在2018年的营收和利润为大家排列了2019城市商业银行排名,其中北京银行以200亿元净利润排在首位,同比增长6.77%。上海银行紧随其后,江苏银行排在第三位达到了130亿元利润。

从城市银行银行的营业收入来看,北京银行以554.88亿元傲立榜首,上海银行营业额上涨32.49%达到了438.88亿元。江苏银行的营业收入增长只有4.09%。另外排名前十的城市商业银行中只有盛京银行净利润下降。下面一起来看看2019城市商业银行排名的详细情况吧。

2019城市商业银行排名| 排名 | 银行 | 2017年营业收入(亿元) | 2018年营业收入 | 营收增速 | 2017年净利润 | 2018年净利润 | 净利润增速 |

| 1 | 北京银行 | 503.53 | 554.88 | 10.2 | 187.33 | 200.02 | 6.77 |

| 2 | 上海银行 | 331.25 | 438.88 | 32.49 | 153.28 | 180.34 | 17.65 |

| 3 | 江苏银行 | 338.39 | 352.24 | 4.09 | 118.75 | 130.65 | 10.02 |

| 4 | 宁波银行 | 253.14 | 289.3 | 14.28 | 93.34 | 111.86 | 19.85 |

| 5 | 南京银行 | 248.39 | 274.06 | 10.33 | 96.68 | 110.73 | 14.53 |

| 6 | 徽商银行 | 225.83 | 269.43 | 19.26 | 76.15 | 87.47 | 14.87 |

| 7 | 哈尔滨银行 | 141.18 | 143.25 | 1.47 | 52.49 | 55.49 | 5.71 |

| 8 | 杭州银行 | 141.22 | 170.54 | 20.77 | 45.5 | 54.12 | 18.94 |

| 9 | 贵阳银行 | 124.77 | 126.45 | 1.35 | 45.31 | 51.37 | 13.39 |

| 10 | 盛京银行 | 132.33 | 158.81 | 20.01 | 75.8 | 51.29 | -32.34 |

| 11 | 厦门国际银行 | 108.43 | 132.3 | 22.02 | 45.37 | 49.07 | 8.14 |

| 12 | 成都银行 | 96.54 | 115.9 | 20.05 | 39.09 | 46.49 | 18.95 |

| 13 | 长沙银行 | 121.28 | 139.41 | 14.95 | 39.31 | 44.79 | 13.94 |

| 14 | 台州银行 | 74.63 | 93.73 | 25.59 | 30.02 | 42.13 | 40.35 |

| 15 | 天津银行 | 101.86 | 121.38 | 19.17 | 39.16 | 41.81 | 6.76 |

| 16 | 重庆银行 | 101.45 | 108.4 | 6.85 | 37.26 | 37.7 | 1.18 |

| 17 | 广州银行 | 81.59 | 109.35 | 34.02 | 32.2 | 37.69 | 17.04 |

| 18 | 甘肃银行 | 80.5 | 88.72 | 10.21 | 33.58 | 34.35 | 2.29 |

| 19 | 昆仑银行 | 54.01 | 67.1 | 24.22 | 29.58 | 32.74 | 10.68 |

| 20 | 郑州银行 | 101.94 | 111.57 | 9.44 | 42.8 | 30.59 | -28.53 |

| 21 | 贵州银行 | 85.21 | 87.36 | 2.52 | 22.81 | 28.83 | 26.38 |

| 22 | 泰隆银行 | 71.64 | 8038 | 12.2 | 23.95 | 27.61 | 15.25 |

| 23 | 江西银行 | 94.63 | 113.51 | 19.95 | 28.65 | 27.34 | -4.6 |

| 24 | 华融湘江银行 | 76.61 | 95.42 | 24.56 | 25.02 | 27.1 | 8.28 |

| 25 | 东莞银行 | 57.56 | 74.95 | 30.22 | 21.22 | 24.57 | 15.78 |

| 26 | 中原银行 | 126.29 | 167.46 | 32.6 | 38.39 | 24.15 | -37.1 |

| 27 | 西安银行 | 49.26 | 59.76 | 21.31 | 21.31 | 23.62 | 10.82 |

| 28 | 兰州银行 | 65.77 | 68 | 3.38 | 23.61 | 22.48 | -4.8 |

| 29 | 苏州银行 | 68.99 | 77.37 | 12.16 | 21.1 | 22.42 | 6.26 |

| 30 | 青岛银行 | 55.83 | 73.72 | 32.04 | 19 | 20.23 | 6.48 |

| 31 | 河北银行 | 74.14 | 67.73 | -8.65 | 26.72 | 19.63 | -26.54 |

| 32 | 张家口银行 | 58.13 | 55.9 | -3.84 | 19.69 | 19.05 | -3.26 |

| 33 | 汉口银行 | 58.03 | 60.76 | 4.71 | 16.91 | 18.92 | 11.87 |

| 34 | 九江银行 | 58.55 | 78.66 | 34.35 | 17.66 | 17.58 | -0.5 |

| 35 | 湖北银行 | 51.01 | 67.39 | 32.12 | 12.55 | 17.52 | 39.65 |

| 36 | 大连银行 | 72.69 | 78.03 | 7.35 | 18.15 | 16.31 | -10.14 |

| 37 | 桂林银行 | 55.44 | 65.29 | 17.78 | 13.43 | 15.49 | 15.29 |

| 38 | 唐山银行 | 35.17 | 29.19 | -17.01 | 15.46 | 15.3 | -1.04 |

| 39 | 龙江银行 | 49.83 | 50.96 | 2.27 | 13.8 | 15.3 | 10.85 |

| 40 | 长安银行 | 46.8 | 55.38 | 18.34 | 13.86 | 15.28 | 10.26 |

| 41 | 廊坊银行 | 53.24 | 50.93 | -4.34 | 15.7 | 15.27 | -2.72 |

| 42 | 华兴银行 | 35.98 | 44.97 | 25 | 12.34 | 15.08 | 22.18 |

| 43 | 稠州银行 | 52.57 | 49.27 | -6.27 | 14.61 | 14.9 | 2.01 |

| 44 | 洛阳银行 | 65.21 | 72.16 | 10.66 | 27.23 | 14.83 | -45.55 |

| 45 | 广东南粤银行 | 53.69 | 53.16 | -0.99 | 13.24 | 14.31 | 8.12 |

| 46 | 厦门银行 | 36.86 | 41.86 | 13.57 | 12.16 | 14.09 | 15.92 |

| 47 | 珠海华润银行 | 36.65 | 48.56 | 32.48 | 11.81 | 13.67 | 15.69 |

| 48 | 天府银行 | 46.53 | 47.09 | 1.2 | 18.09 | 13.57 | -24.99 |

| 49 | 晋商银行 | 43.98 | 45.85 | 4.23 | 12.27 | 13.2 | 7.54 |

| 50 | 乌鲁木齐银行 | 32.56 | 33.95 | 4.26 | 12.78 | 13.16 | 3 |

| 51 | 重庆三峡银行 | 39.19 | 37.78 | -3.61 | 18.12 | 12.8 | -29.36 |

| 52 | 吉林银行 | 89.32 | 87.19 | -2.38 | 29.37 | 11.57 | -60.6 |

| 53 | 沧州银行 | 33.85 | 36.16 | 6.82 | 10 | 11.2 | 12.08 |

| 54 | 辽阳银行 | 20.4 | 31.35 | 53.7 | 10.08 | 10.82 | 7.3 |

| 55 | 威海市商业银行 | 38.94 | 38.46 | -1.23 | 15.67 | 9.56 | -39.01 |

| 56 | 承德银行 | 25.17 | 30.01 | 19.22 | 9.54 | 9.42 | -1.27 |

| 57 | 广西北部湾银行 | 21.93 | 33.79 | 54.1 | 7.74 | 9.25 | 19.56 |

| 58 | 赣州银行 | 25.62 | 31 | 20.97 | 7.6 | 8.45 | 11.14 |

| 59 | 营口沿海银行 | 15.33 | 19.66 | 28.31 | 7.98 | 8.01 | 0.34 |

| 60 | 乌海银行 | 14.58 | 14.55 | -0.19 | 7.77 | 7.97 | 2.56 |

| 61 | 日照银行 | 28.37 | 37.85 | 33.38 | 6.49 | 7.41 | 14.3 |

| 62 | 潍坊银行 | 30.37 | 34.71 | 14.31 | 7.07 | 7.39 | 4.46 |

| 63 | 上饶银行 | 27.72 | 32.3 | 16.52 | 6.74 | 7.25 | 7.53 |

| 64 | 宁波通商银行 | 17.64 | 20.66 | 17.15 | 6.41 | 7.12 | 11.02 |

| 65 | 东营银行 | 18.92 | 21.66 | 14.46 | 7.21 | 6.73 | -6.69 |

| 66 | 泸州银行 | 16.81 | 19.34 | 15.09 | 6.19 | 6.58 | 6.4 |

| 67 | 民泰银行 | 35.72 | 39.15 | 9.6 | 5.5 | 6.5 | 18.22 |

| 68 | 绵阳银行 | 15.13 | 20.68 | 36.75 | 6.34 | 6.34 | -0.13 |

| 69 | 嘉兴银行 | 19.1 | 21.04 | 10.11 | 6.64 | 6.29 | -5.22 |

| 70 | 葫芦岛银行 | 18.77 | 22.36 | 19.1 | 5.69 | 6.18 | 8.73 |

| 71 | 营口银行 | 25.63 | 27.46 | 7.14 | 6.31 | 5.83 | -7.7 |

| 72 | 宁夏银行 | 32.38 | 35.87 | 10.79 | 8.31 | 5.75 | -30.78 |

| 73 | 红塔银行 | 15.19 | 19.91 | 31.08 | 3.03 | 5.64 | 86.42 |

| 74 | 济宁银行 | 18.63 | 25.02 | 34.32 | 5.18 | 5.44 | 5.07 |

| 75 | 内蒙古银行 | 23.87 | 26.71 | 11.9 | 5.05 | 5.43 | 7.42 |

| 76 | 抚顺银行 | 16.18 | 18.65 | 15.26 | 7.52 | 5.1 | -28.09 |

| 77 | 秦皇岛银行 | 11.24 | 14.82 | 31.89 | 4.73 | 5.39 | 14.15 |

| 78 | 齐商银行 | 26.95 | 25.67 | -4.72 | 4.88 | 5.31 | 8.84 |

| 79 | 乐山银行 | 20.71 | 20.73 | 0.11 | 6.51 | 5.28 | -18.93 |

| 80 | 晋城银行 | 19.07 | 28.1 | 47.36 | 5.43 | 5.13 | -5.52 |

| 81 | 温州银行 | 39.71 | 36.18 | -8.89 | 9.02 | 5.1 | -43.46 |

| 82 | 达州银行 | 11.22 | 5.69 | 4.95 | -12.88 | ||

| 83 | 长城华西银行 | 23.74 | 23.13 | -2.56 | 6.83 | 4.9 | -28.21 |

| 84 | 湖州银行 | 13.59 | 16.48 | 21.25 | 3.15 | 4.89 | 55.08 |

| 85 | 海峡银行 | 30.07 | 27.9 | -7.22 | 6.5 | 4.75 | -26.97 |

| 86 | 莱商银行 | 25.56 | 31.96 | 25.04 | 4.64 | 4.67 | 0.7 |

| 87 | 遂宁银行 | 10.64 | 11.47 | 7.83 | 5.21 | 4.38 | -16 |

| 88 | 晋中银行 | 18.21 | 13.47 | -26.03 | 3.79 | 4.34 | 14.71 |

| 89 | 泰安银行 | 14.45 | 12.76 | -11.74 | 6.2 | 4.22 | -31.99 |

| 90 | 绍兴银行 | 18.06 | 19.52 | 8.07 | 4.2 | 4.05 | -3.54 |

| 91 | 邢台银行 | 21.79 | 21.2 | -2.7 | 6.93 | 3.99 | -42.41 |

| 92 | 阜新银行 | 23.68 | 20.22 | -14.59 | 7.38 | 3.74 | -49.31 |

| 93 | 泉州银行 | 16.97 | 20.65 | 21.66 | 3.66 | 3.62 | -1.22 |

| 94 | 丹东银行 | 19.99 | 16.48 | -17.56 | 3.6 | 3.51 | -2.45 |

| 95 | 柳州银行 | 27.1 | 31.06 | 14.62 | 0.76 | 3.45 | 354.46 |

| 96 | 临商银行 | 23.09 | 22.81 | -1.2 | 5.87 | 3.22 | -45.11 |

免责声明:

本文《2019城市商业银行排名 北京银行净利润达200亿居首位(完整榜)》版权归原作者所有,内容不代表本站立场!

如本文内容影响到您的合法权益(含文章中内容、图片等),请及时联系本站,我们会及时删除处理。

推荐阅读

重庆十大夏季避暑旅游景点 武陵山大裂谷上榜 芙蓉洞排第二

重庆十大夏季避暑旅游景点1、仙女山国家森林公园仙女山地属武陵山脉,距重庆市主城区180千米,海拔2033米,拥有森林33万亩,天然草原10万亩。以其江南独具魅力的高山草原,南国罕见的林海雪原,青幽秀美...

阅读: 2822

澳门十大夏季避暑旅游景点 澳门观光塔排名第二 澳门渔人码头上榜

澳门十大夏季避暑旅游景点1、威尼斯人度假村酒店5星酒店澳门威尼斯人度假村酒店占地1,050万平方尺,设有3,000间豪华套房,以意大利威尼斯水乡以及雕像为建筑特色,并参考拉斯维加斯威尼斯人度假村酒店作...

阅读: 2929

河北十大夏季避暑旅游景点 承德避暑山庄第一 张北草原上榜

河北十大夏季避暑旅游景点1、承德避暑山庄世界遗产5A景区承德避暑山庄是世界文化遗产,又名热河行宫”,园内亭、阁、轩、榭、庙宇等120余组景观,为中国四大名园之一,是清代皇帝夏天避暑和处理政...

阅读: 669

山西十大夏季避暑旅游景点 北武当山排第三 九女仙湖上榜

山西十大夏季避暑旅游景点1、五台山世界遗产5A景区国家风景名胜区国家地质公园五台山景区规划面积607平方千米,森林植被覆盖率达到了80.5%以上,夏季平均气温也在6-18度之间,是天然氧吧&rdquo...

阅读: 2320

台湾十大夏季避暑旅游景点 高美湿地排第三 台湾七星潭上榜

台湾十大夏季避暑旅游景点1、日月潭日月潭,旧称水沙连、龙湖、水社大湖、珠潭、双潭,位于中国台湾阿里山以北、能高山之南的南投县鱼池乡水社村,为日潭与月潭之合称。日月潭,以光华岛为界,北半湖形状如圆日,南...

阅读: 3316

陕西十大夏季避暑旅游景点 华山排名第一 丹江漂流上榜

陕西十大夏季避暑旅游景点1、华山5A景区国家风景名胜区国家地质公园华山位于陕西省渭南市华阴市,著名景区多达210余处,其中华岳仙掌被列为关中八景之首,是中华十大名山之一。夏季的华山,平均温度25℃左右...

阅读: 563

金华十大夏季避暑旅游景点 仙华山风景名胜区排第二 仙源谷漂流上榜

金华十大夏季避暑旅游景点1、双龙风景名胜区国家风景名胜区4A景区金华双龙风景区素有双龙胜景,大仙圣地,禅学中心,浙中凉都”之美誉,是一处以山岳森林为背景,地下悬河、岩溶景观、道教胜地为特色...

阅读: 2125

邯郸十大夏季避暑旅游景点 聚龙山莲花洞第三 朝阳沟上榜

邯郸十大夏季避暑旅游景点1、京娘湖国家水利风景区4A景区京娘湖亦称口上水库,京娘湖有太行三峡”之称。这里山水环绕,群峰竞秀,层峦叠嶂,川谷深幽,赤壁丹崖,色彩斑斓,林木茂盛,波光粼粼,风景...

阅读: 3381

绵阳十大夏季避暑旅游景点 富乐山公园上榜 佛爷洞排第二

绵阳十大夏季避暑旅游景点1、仙海国家水利风景区4A景区仙海旅游度假区是以仙海湖为中心的核心区,由6.8平方公里的浅丘低山和7平方公里的水面构成,森林覆盖率达90%,湖面纵深视野达3.8公里,形成有46...

阅读: 1676

贵阳十大夏季避暑旅游景点 阿哈湖湿地公园上榜 黔灵山公园排第四

贵阳十大夏季避暑旅游景点1、南江大峡谷漂流瀑布峡谷4A景区南江大峡谷以发育典型,气势宏大的喀斯特峡谷风光和类型多样、姿态各异的瀑布群落为特色,其景色壮丽,气象万千,集奇峰、峡谷、峭壁、断崖、瀑布、跌水...

阅读: 2666

更多排行榜

热门文章

1.最美的花是什么花 你叫得上名字的有几种

- 1

- 最美的花是什么花 你叫得上名字的有几种

- 2022-06-01

- 1

2.三级跳世界纪录是多少米 最远跳远世界纪录的人是谁

- 2

- 三级跳世界纪录是多少米 最远跳远世界纪录的人是谁

- 2022-06-01

- 2

3.标枪世界纪录是多少 104.80米的成绩打破世界纪录

- 3

- 标枪世界纪录是多少 104.80米的成绩打破世界纪录

- 2022-06-01

- 3

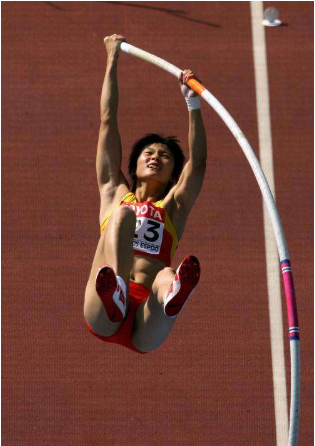

4.男子撑杆跳世界纪录 撑杆跳世界纪录最优秀的运动员

- 4

- 男子撑杆跳世界纪录 撑杆跳世界纪录最优秀的运动员

- 2022-06-01

- 4

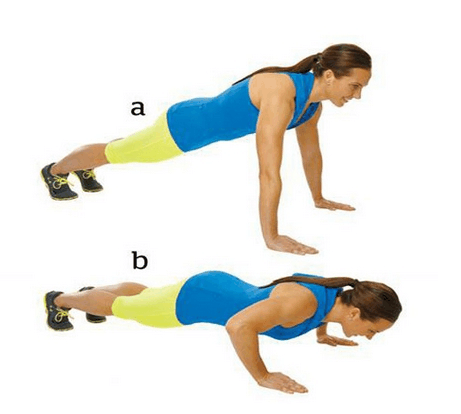

5.一分钟单手俯卧撑世界纪录多少个 俯卧撑有什么健身效果

- 5

- 一分钟单手俯卧撑世界纪录多少个 俯卧撑有什么健身效果

- 2022-06-01

- 5

6.100米自由泳世界纪录是多少 100米自由泳吉尼斯记录

- 6

- 100米自由泳世界纪录是多少 100米自由泳吉尼斯记录

- 2022-06-01

- 6

7.男子110米栏世界纪录是多长时间 史上最强110米栏运动员

- 7

- 男子110米栏世界纪录是多长时间 史上最强110米栏运动员

- 2022-06-01

- 7

8.女子百米世界纪录是多少 历史上最快的女飞人

- 8

- 女子百米世界纪录是多少 历史上最快的女飞人

- 2022-06-01

- 8

9.2018全程马拉松最新世界纪录 跑马拉松大概要长时间

- 9

- 2018全程马拉松最新世界纪录 跑马拉松大概要长时间

- 2022-06-01

- 9

10.自由泳赛事纪录排行榜 200米自由泳世界纪录名单

- 10

- 自由泳赛事纪录排行榜 200米自由泳世界纪录名单

- 2022-06-05

- 10

最近更新

2019穿越小说排行榜TOP6

2022-06-05

中国的世界之最有哪些 你知道多少

2022-06-05

世界上人口最多的国家是中国吗

2022-06-05

全球人口最多的国家 预计2050年印度会超过中国

2022-06-05

海洋生物之最 世界最大的海洋生物是什么

2022-06-05

世界上最毒的蜘蛛是哪种 十大毒蜘蛛蜘

2022-06-05

世界上最聪明的狗 智商最高的狗是哪种

2022-06-05

全球最贵的男鞋 世界上最贵的鞋子价值多少

2022-06-05

地球之最 世界上最神秘的生物你知道几种

2022-06-05

世界上最小的岛在哪 全球最小的岛国

2022-06-05